The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes, including the education tax portion. This is done through a low-interest home equity loan with the Government of Alberta.

Eligibility is not based on your income. To be eligible for this program, you must:

- be 65 years of age, or older (only one spouse/partner needs to be at least 65)

- be an Alberta resident, having lived in the province at least 3 months

- own a residential property in Alberta and the home must be your primary residence (the place where you live most of the time)

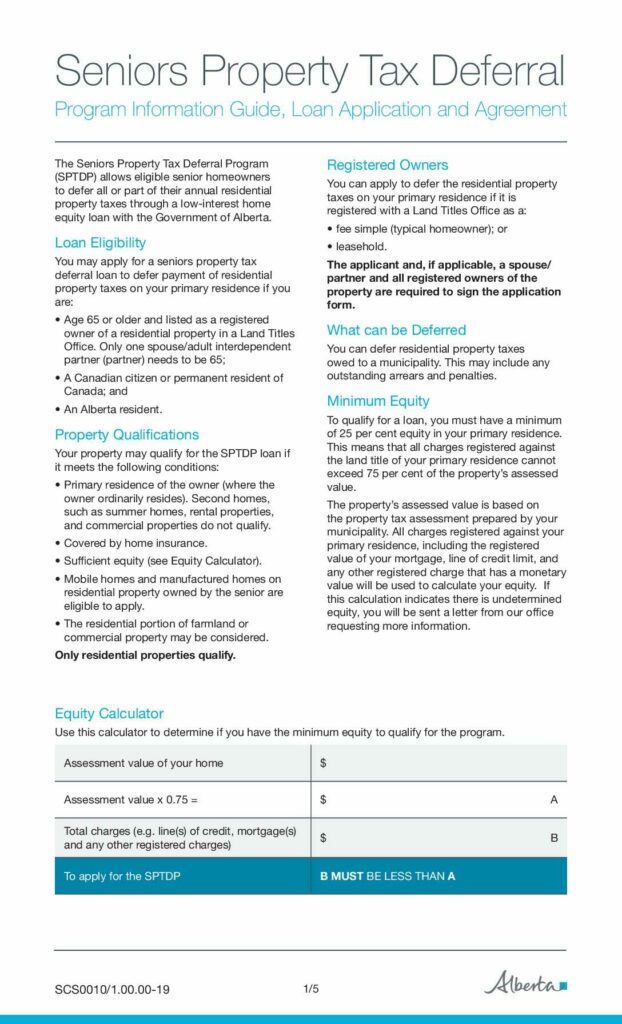

- have a minimum of 25% equity in your home to allow the government to secure the loan and ensure repayment when the loan is due.

Help with this resource is available through Alberta Supports, call 1-877-644-9992.

Downloads

seniors-property-tax-deferral-application-web

377 KB, pdf